International arbitration in 2025

Geopolitical shifts: new political agendas driving investment treaty claims

By Noiana Marigo, Lee Rovinescu, Xin Liu and Gregorio Pettazzi

In brief

In 2025, investment claims are likely to be shaped by major geopolitical shifts that have developed in recent years. Most noteworthy are the new administrations in Mexico and the US, the fate of the war in Ukraine and China’s trade and foreign investment policies. Investors who may be exposed to adverse action in connection with these developments should review their corporate structures and take necessary action to ensure that their investments are protected by investment treaties.

Title

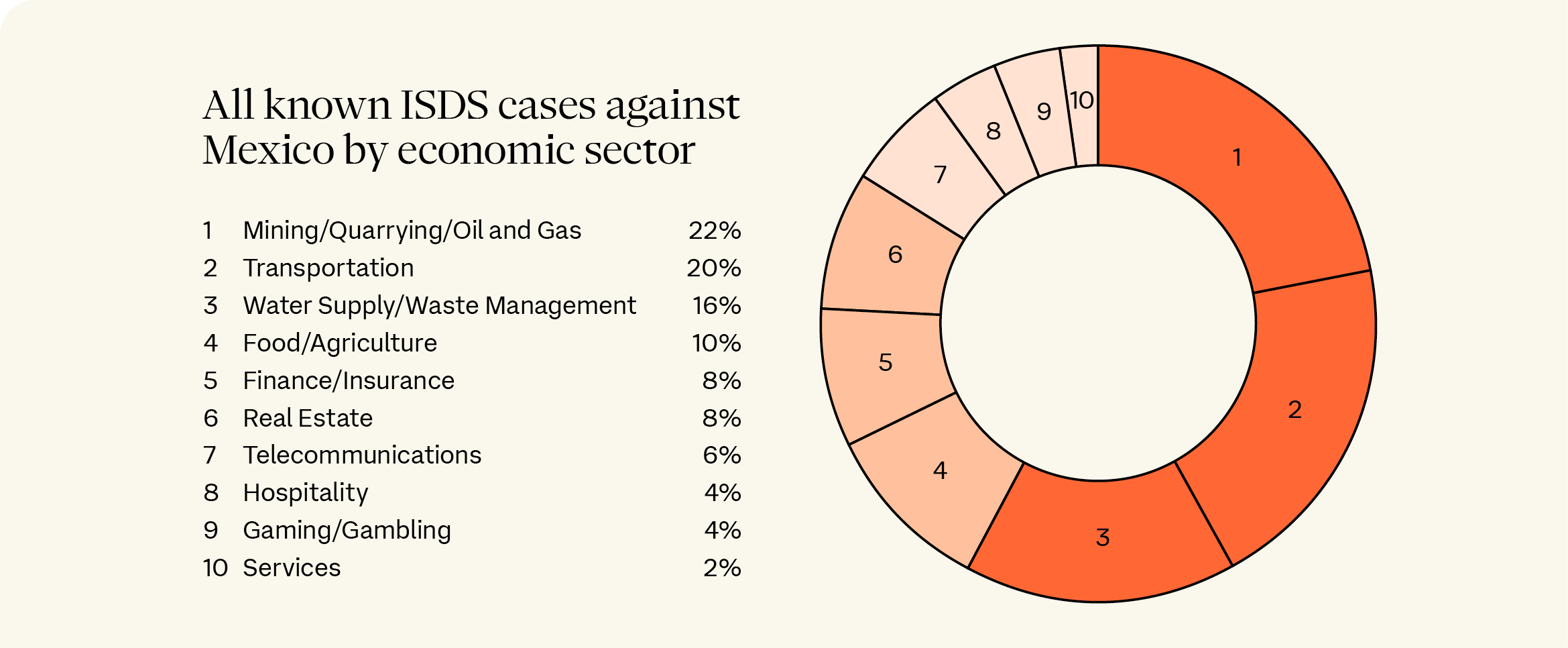

LatAm: the wave of investment claims against Mexico expected during AMLO’s administration might finally arrive in the Sheinbaum administration

Last year, Mexico saw record levels of foreign investment, mainly due to its position as the best nearshoring option in the region. Investors appear to have been comforted by checks and balances in the Mexican legal system that prevented former President Andrés Manuel López Obrador (AMLO) from taking sweeping action against foreign investment that had been anticipated earlier in his administration. While the nearshoring trend is likely here to stay, the country’s investment climate has become more complicated due to a series of controversial reforms introduced by Mexico’s new President, Claudia Sheinbaum, along with the Trump administration’s increasingly aggressive stance towards Mexico, including the recent imposition of a 25 percent tariff on Mexican imports.

At the forefront of the Sheinbaum administration’s reforms is the overhaul of the Mexican judiciary, imposing popular elections for all federal judges, including Supreme Court justices. In addition, a number of independent regulators have been abolished. Experts see these reforms as a threat to the rule of law and an attempt to concentrate power in the executive branch. Sheinbaum has targeted key productive industries, such as the energy sector, increasing the dominance of state-owned players, and the mining sector, seeking to ban open-pit mining.

![]() 2025 is shaping up to be a pivotal year for Mexico, especially in light of the new reforms sponsored by the Sheinbaum administration. Moreover, the next few months will be crucial in shaping the future of trade relations between Mexico, Canada, and the US.

2025 is shaping up to be a pivotal year for Mexico, especially in light of the new reforms sponsored by the Sheinbaum administration. Moreover, the next few months will be crucial in shaping the future of trade relations between Mexico, Canada, and the US. ![]()

Noiana Marigo

Partner

These structural changes are likely to be a significant driver of future investment claims against Mexico. In this context, investor-state dispute settlement (ISDS) remains the safest mechanism to protect foreign investments in the country, especially given the increased uncertainty of the effectiveness of domestic remedies following the judicial reform. Historically, Mexico has a reassuring track record when it comes to compliance with adverse investment treaty awards.

Europe: the war in Ukraine remains front and center

Since 2022, the war in Ukraine has shaped Russia’s relationship with the international community. The severe sanctions imposed on Russia – as well as Russia’s countermeasures against companies from “unfriendly” countries – have prompted many investors to reconsider their business dealings in the region. Although a wave of treaty claims arising from this conflict has been long anticipated, only a few investors have so far announced their intention to pursue treaty claims against Russia, including Finnish Fortum, Danish Carlsberg and German Uniper.

Several factors may explain this hesitation. Investors might have been reluctant to sever ties with Russia, having hoped for a swift end to the conflict and a chance to resume normal business operations. Additionally, enforcement of large awards against Russia, such as the US$50bn Yukos award, remain pending. This, coupled with Russia’s track record of aggressively challenging any adverse award rendered against it may act as a deterrent for new claims. That said, in many instances, ISDS remains the only viable option for foreign investors who saw their investments in Russia impaired or destroyed.

President Trump and President Putin have both stated that they are open to a ceasefire deal, but uncertainties remain.

Investors who exited Russia should carefully consider whether they are entitled to compensation under applicable BITs. Those who are still operating there should consider investment treaty protection when implementing their risk mitigation strategies.

Asia: China begins a new era of outbound investment amid escalating geopolitical tensions

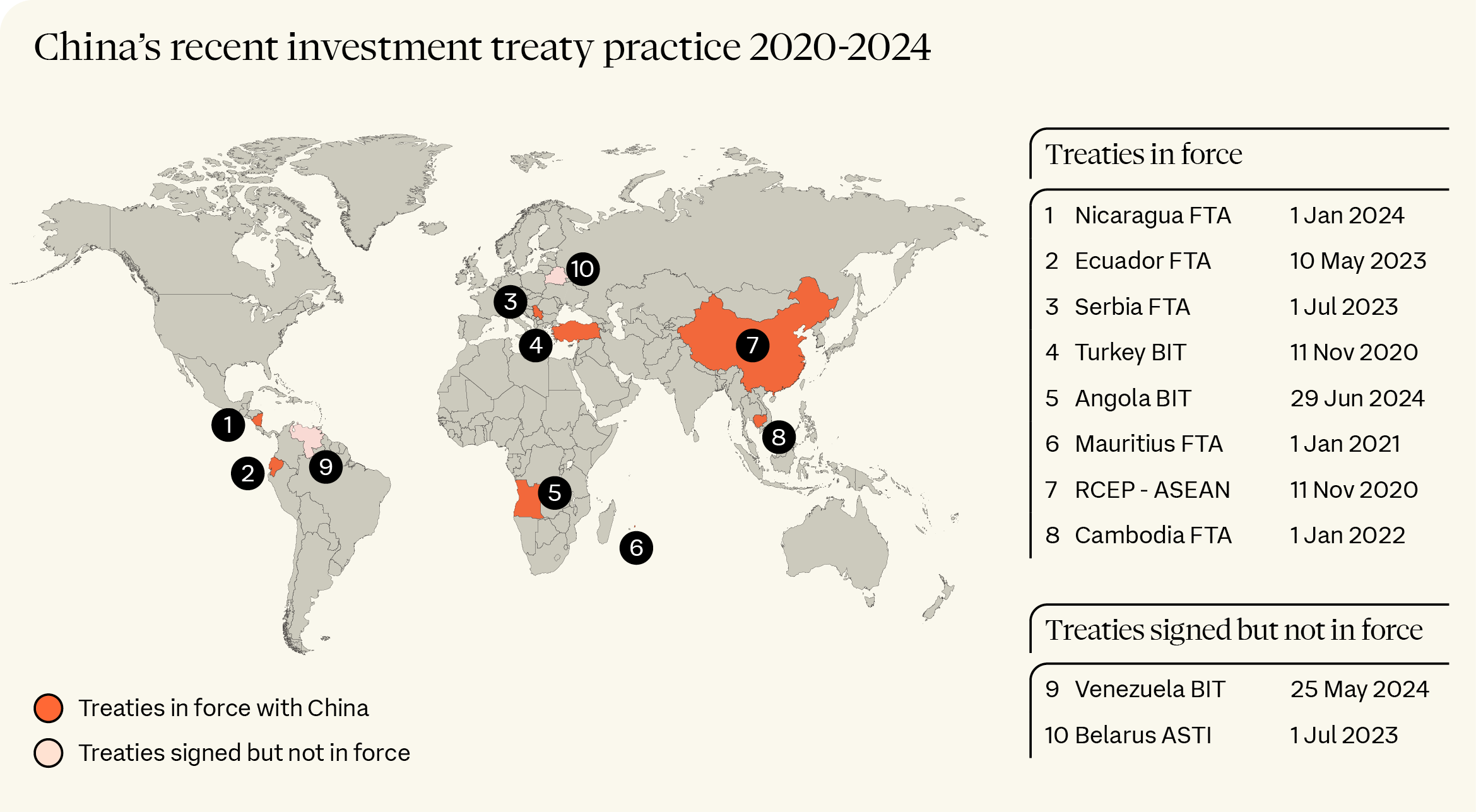

Following a period of deceleration, Chinese companies are once again ramping up their outbound investments, prioritizing emerging markets over G7 economies. China also continues to intensify its treaty engagements, with a further increase in BITs and FTAs since 2023.

World map highlighting countries that have BITs/FTAs with China.

The Chinese investment landscape is increasingly challenged by rising tensions with major developed economies. Investors are wary of a potential “US-China trade war 2.0”, already started with President Trump’s imposition of an additional 10 percent levy on Chinese imports. Heightened geopolitical tensions have led to stricter investment reviews and national security measures targeting Chinese companies in the US, EU, and other G7 nations, prompting China to retaliate with investigations into major US and EU companies.

Regulatory alignment efforts among leading economies may provoke further restrictions against Chinese investments elsewhere. In 2024, for example, mounting pressure over Chinese investments in Mexico culminated in President Biden imposing a 100 percent duty on electric vehicles made there. Concurrently, Mexico enacted tariffs on Chinese textile imports, reflecting calls for regulatory coordination among USMCA countries.

![]() Chinese outbound investments are increasingly moving towards emerging markets in Southeast Asia, Africa, Latin America, and the Middle East. The economic and political instability in some of these regions constitutes a significant risk. Yet, Chinese investors can enhance treaty protection through the expanding network of Chinese BITs and effective investment structuring.

Chinese outbound investments are increasingly moving towards emerging markets in Southeast Asia, Africa, Latin America, and the Middle East. The economic and political instability in some of these regions constitutes a significant risk. Yet, Chinese investors can enhance treaty protection through the expanding network of Chinese BITs and effective investment structuring. ![]()

Xin Liu

Partner

In response to this challenging environment, China is redirecting its outbound investments toward emerging markets in Southeast Asia, Africa, Latin America, and the Middle East, particularly in countries participating in the Belt and Road Initiative. However, economic and political instability in these regions raises the risk of BIT disputes. Notably, in 2024, Chinese miners encountered illegal extraction issues and blockades in Colombia, while the Democratic Republic of Congo expressed intentions to diversify its investor base to mitigate China’s dominance in the mining sector.

As a result, investors must brace for increased state interventions and strategically structure their investments to secure access to international dispute resolution mechanisms. Case law, particularly from NAFTA disputes, demonstrates that ISDS can offer effective remedies for investors entangled in trade conflicts.

Looking ahead: practical takeaways

We anticipate a highly volatile investment landscape due to these significant geopolitical shifts. We recommend any investor operating in these regions to consider the following practical steps:

-

Assess investment protection frameworks: carefully evaluate the applicable investment protection treaties available in the jurisdiction in which your investments are located to ensure that they are adequately safeguarded.

-

Evaluate if restructuring is necessary: if current protections are insufficient, take swift action to restructure investments to ensure access to ISDS mechanisms. Proper structuring before a dispute arises is crucial for securing ISDS protection.

-

Monitor legal developments: closely monitor any legal developments and investor-related measures, as aggressive actions may be taken quickly with little to no warning in the current geopolitical climate. Timely challenges to these measures can be critical in an eventual dispute.

Our team of global ISDS specialists brings expertise across these regions, helping businesses navigate and safeguard their interests in today's increasingly complex geopolitical landscape.

If you'd like to discuss any of these topics in more detail, or anything else, your Freshfields contact would be glad to assist.

- Introduction

- 1. AI in international arbitration: a fast-evolving landscape

- 2. Geopolitical shifts: new political agendas driving investment treaty claims

- 3. Russian disputes and anti-suit injunctions: arbitration and state courts - allies, adversaries, or both?

- 4. Investor-state mediation: a bridge over troubled waters?

- 5. Human rights and social issues in investment treaty arbitration: a growing trend

- 6. Arbitration as a tool for private capital disputes

- 7. Arbitration of space disputes: time for take-off

- 8. Game-changing sports disputes: a new normal

- 9. Privilege in arbitration – should one set of rules apply?

- 10. The shift from EPC to EPCM: a recipe for more complex arbitrations?

- 11. The internationalization of arbitration in Brazil: a rising trend

- 12. Shifting sands: the Middle East’s evolution into an arbitration hub